Credit Builder Auto Loan

Improve Your Credit Score - Lower Your Interest Rate

Get rewarded for reaching your financial goals.

With the Credit Builder Car Loan you can improve your rate as your credit score improves.

Credit Builder Car Loan

Pay a lower interest rate when you improve your credit score

The Credit Builder Auto Loan not only helps you drive the vehicle you need but also rewards you for improving your credit score.

Highlights

- SCU will reward your financial progress! - Benefit from the opportunity to reduce your interest rate up to twice during the loan term, based on improvements to your credit score.

- Flexible Financing Options - Enjoy terms up to 84 months for a new car and up to 75 months for a used car, giving you affordable monthly payments.

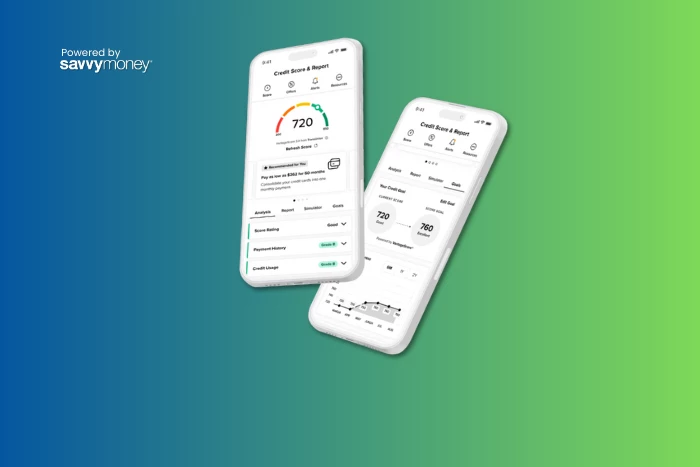

Take Control of Your Credit Score

Having a good credit score can unlock access to favorable loans and rewards on credit cards while saving you money through better rates. On the SCU app, you can get your current score and personalized advice on how to improve it. All for free. All for you.

If you are a member sign into online banking and activate SavvyMoney

Credit Builder Auto Loan | Frequently Asked Questions